By FCSAmerica Staff

Published on Jul 14, 2025

Farmland values held steady in the first six months of 2025, an indicator of two economic dynamics shaping the U.S. grain industry — solid farm financials tempered by market uncertainty.

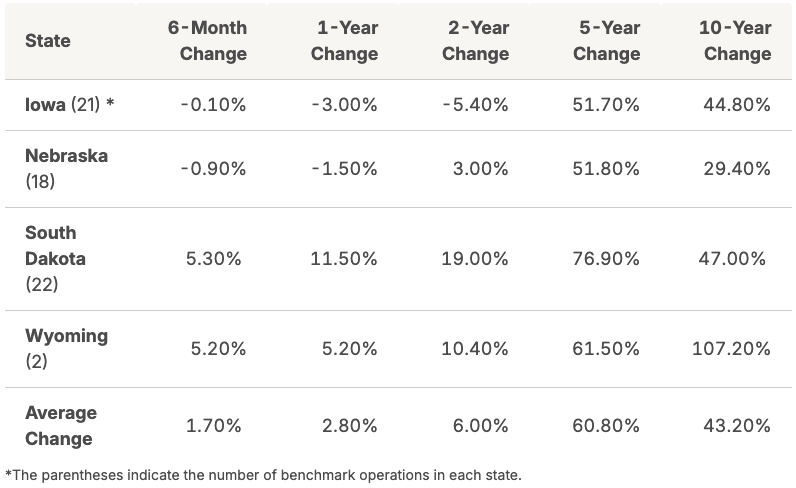

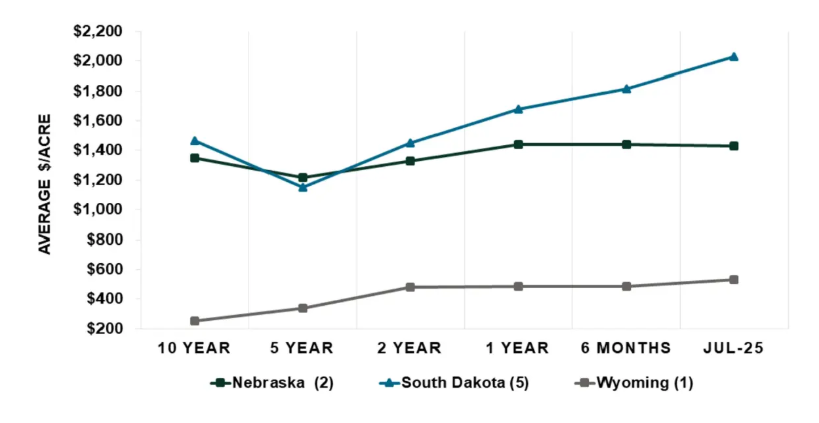

Farm Credit Services of America (FCSAmerica) tracks values on the same 63 benchmark farms every January and July. In the first half of 2025, values were largely flat, increasing an average of 1.70% across Iowa, Nebraska, South Dakota and Wyoming.

Iowa and Nebraska each saw slight declines. This was the second consecutive dip for the two states, although values remain near their record highs. Average farmland values ticked up in South Dakota and Wyoming.

Yearly Farmland Value Trends by State

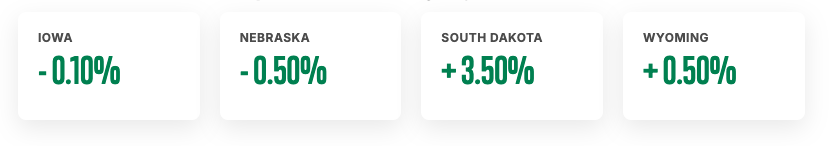

Most benchmarks are cropland, but pasture or a combination of crop and pasture also are included. Among the cropland benchmarks, Iowa has experienced a decline of -0.10% and -3.60% for the same period in 2025 and 2024, respectively. Nebraska cropland values are down -0.50% since January 1 and -1.20% compared to a year ago.

South Dakota cropland values have improved 3.50% and 6.20% in the past six and 12 months, respectively, while Wyoming has remained stable, increasing a modest 0.50% during the past year.

Benchmark Cropland Value Changes

6-Month Benchmark Cropland Value Change by State

High beef prices continue to support the pasture market in South Dakota, where benchmark values have risen 14.20% since January and 26.2% compared to a year ago. Wyoming has seen a 9.90% increase during the past year, while Nebraska’s pasture values were unchanged from 12 months ago, when they experienced a modest -1.00% loss. Iowa does not have pasture benchmark farms.

Benchmark Pasture/Ranch Value Changes

6-Month Benchmark Pasture/Ranch Value Changes by State

Continued Local Real Estate Market Volatility

The pockets of volatility in local real estate markets that developed in 2024 continue into 2025, with some sale prices higher than expected and some lower. Tim Koch, executive vice president of business development, said this volatility is to be expected.

Averaged across all sales, prices for Iowa farmland have stabilized; the average second quarter price of $12,445 per acre was slightly above the first quarter of 2025 (sale prices are separate from benchmark farmland values).

By comparison, South Dakota’s near-record average sale price in the first quarter fell 12.6% in the second quarter to $6,767 per acre. Nebraska dryland cropland sold at its lowest price since 2020, finishing the second quarter at $4,060 per acre. This was influenced by productivity of land sold, which fell below historical averages. Irrigated prices dropped 8.3% from the first to second quarter of 2025 for an average of $7,975 per acre.

Factors Impacting Land Values

While sales activity influences land values, other factors also come into play, helping to cut through noise in the market, Koch said: “The fact that land values are flat and not down tells us that overall, the financial landscape for agriculture is pretty good right now, and this continues to be supportive of real estate values.”

Heading into 2025, some prognosticators expected corn prices to fall to the low $4-, high $3-range, creating financial stress and an increase in fire sales of land.

Instead, corn prices have remained in the mid-$4 range. Producers also received a fresh round of federal farm subsidies earlier this year to offset weather and economic challenges.

There are pockets of stress, Koch noted, but they remain a small part of the overall economic picture. As a result, land sales due to duress have not impacted the real estate market. In fact, the same tight land market that supported land values for the past several years remains in place.

Total cropland sales in Iowa tumbled 40.6% in the second quarter compared to the same period in 2024. Dryland cropland sales in Nebraska were largely unchanged, but irrigated land sales declined about 23.8% in the second quarter. South Dakota sales held at 2024 levels. The state of Wyoming does not require public reporting of land sales, making it difficult to track trends in sales activity.

Challenges and Uncertainty Ahead

Challenges do lie ahead for agriculture, the most immediate being the 2025 corn harvest. Based on current crop conditions and the 95 million acres of U.S. corn hit trendline, farmers could deliver a bumper crop — potentially into a market with fewer buyers.

So far, the U.S. has found willing buyers for its agricultural products. A weakened dollar and strong demand have helped ease the impact of tariffs and trade disputes. But with the Trump administration threatening more tariffs and trade talks in flux, farmers enter the 2025 harvest in a state of uncertainty.

“Unlike short-term commodity price swings or isolated financial stress, land values reflect long-term confidence,” he said. “When producers are still willing to invest in farmland, it tells us they believe in the future of the industry. That kind of stability is a grounded, tangible signal of where agriculture really stands.”

But there isn’t a scenario in which land values consistently improve, he noted, and looking ahead to the remainder of 2025, values likely will experience downward pressure.

Strong Working Capital and Selective Land Investment

Working capital, while well off the record highs of recent years, remains relatively strong. This is largely due to commodity prices staying higher for longer, but also because of additional support from government subsidies, Koch said.

If commodity prices come under pressure, and that is a possibility, the real estate market will see fewer buyers, he said. Beginning in 2024, buyers already were growing more selective, waiting for the right land in the right location to come on the market and forgoing a growing number of public auctions.

In the first half of 2025, South Dakota saw no-sale public auctions climb to levels last seen in 2017. However, Iowa saw fewer no-sale auctions after the highs of 2023 and 2024.

Koch said he wouldn’t expect a material shift in land values between now and the end of 2025. But, he added, the market could see a modest shift of a couple points across the board, with anomalies showing up in certain locales based on the quality of land sales.

To view the full article on the Farm Credit Services of America website, Click Here.